MARCH MARKET UPDATE

We’re entering prime time for the real estate market, and more listings are on the way.

Figures for February show year-over-year (YOY) gains in new listings, pending sales, closed sales, and prices. Expect a bump-up in inventory during March and April, but we remain virtually sold out in many areas in the more affordable and mid-price ranges. It’s still too early to tell if the broadening effects of the coronavirus will sideline buyers. What we do know is that news of the virus led equity markets sharply lower and this caused mortgage rates to drop significantly.

Therefore, the question is whether buyers will put their search on hold until the virus has abated, or if they will decide to move forward so they don’t miss out on near historic low mortgage rates. It remains to be seen if the coronavirus scare will have any impact at all on the local real estate market other than to lower interest rates. While the news is full of COVID-19, the stock market correction, and an unexpected interest rate cut that didn’t impress Wall Street, the Puget Sound region’s real estate market continues to stand strong. Agents aren’t yet seeing any impact on open house attendance due to the COVID-19 outbreak.

We continue to be bullish on the Puget Sound economy and real estate market. There aren’t any noticeable decrease in open house activity or in sellers being reluctant to have buyers view their home. Short term, the coronavirus outbreak has resulted in investors turning to the bond market, which means lower interest rates and more buying power. Long-term, this virus could start to wear on overall consumer confidence, which is never good for real estate markets. Historically low interest rates should help the housing market sustain strong momentum during the coronavirus outbreak.

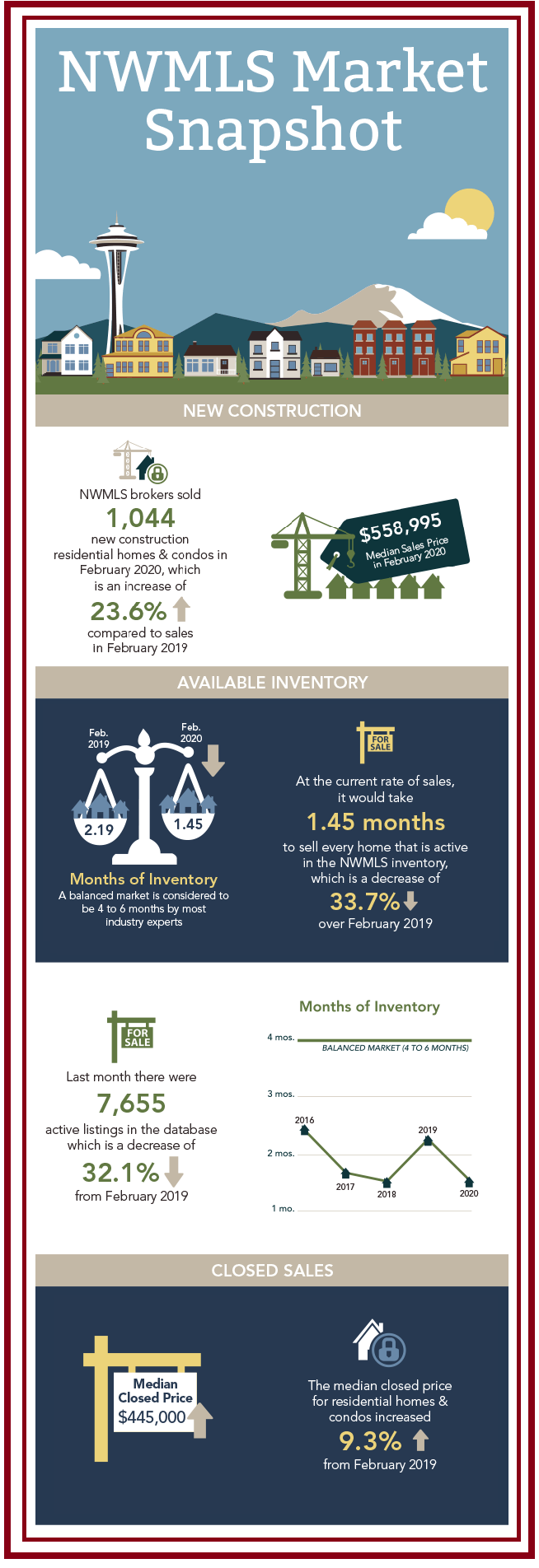

Inventory remained tight. At month end, there were 7,655 active listings in the 23 counties. That was a 32% drop from the year ago total of 11,275. All but two counties (San Juan and Douglas) reported declines. Thurston County had the largest year-over-year drop, at 45.7%, followed by Snohomish (down 42%) and King (down 40.7%). There is only 1.45 months of supply area-wide. It is even more sparse in the four-county Puget Sound region where there is barely over a month’s supply (1.1 months). Snohomish and Thurston counties had the distinction of having the sparsest inventory, with both areas reporting less than a month (0.93) of supply. The Snohomish County housing market continued on a torrent pace during February. Low inventory, a return to historically low interest rates, and plenty of buyer demand are stimulating the activity. In many cases, sellers are receiving multiple offers exceeding the asking price.

The spring market has arrived. Multiple offers are normal in hot market areas, and many buyers are having pre-inspections before making offers to sellers. Buyers are taking advantage of historically low interest rates and low down payment programs such as FHA with 3.5% down, zero down VA, and low down conventional mortgages. Current listings are attracting brisk activity. Almost every new listing has had tremendous showing activity and multiple offers. Open house activity as “above average.” More than 400 buyers previewed four listings in the past 10 days. A north King County property in the $600,000 price range that was on the market for a week with an offer review on Tuesday had eight offers at $100,000 over the asking price.

Ultra-tight inventory is terrific news for sellers, but it creates challenges for buyers, especially move-up buyers who are selling and buying in the same market. Buyers who need to sell before they buy a different home are experiencing the very real dilemma of either being a contingent buyer, which no seller will even remotely consider, or of possibly being temporarily homeless if their home sells quickly and they can’t find a replacement. Having a broker who can help navigate that terrain is super important. Buyers’ pent-up demand continues to grow despite “turmoil in the marketplace, stocks riding a roller coaster, falling mortgage interest rates and shrinking inventory.”

Buyers in Kitsap County have little to choose from with YOY inventory being down about 30%. At any given open house there is heavy traffic and most new listings that are correctly priced are receiving multiple offers. Due to the housing shortage in Kitsap County, some buyers are turning to alternatives, such as buying land and moving a mobile home onto it or purchasing land with the intent to build a home. New construction cannot go up fast enough and unless it is already permitted, there would be two years’ worth of studies and permitting before any nails are driven. Agents in Kent recently reported putting homes on the market and receiving multiple offers within three days. At a Bellevue listing, more than two dozen couples attended an open house this past weekend.

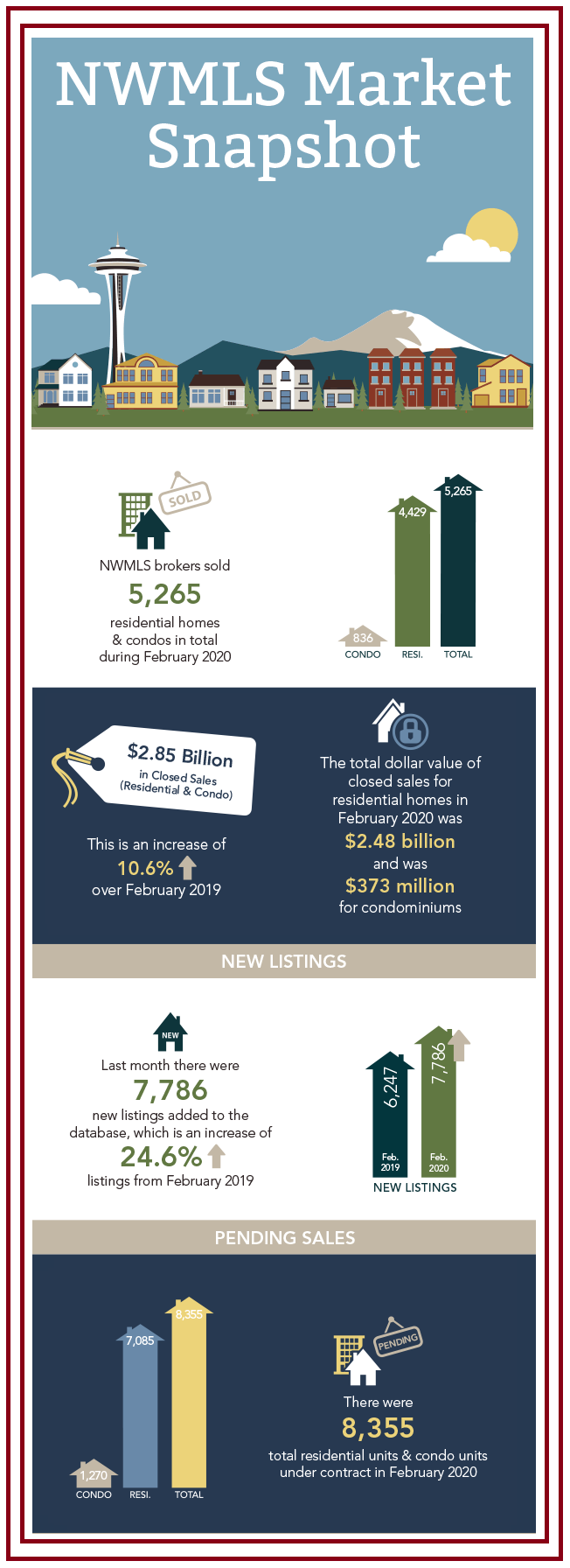

The supply-demand imbalance is contributing to rising prices. The report shows the median price system-wide for the 5,265 homes and condos that sold in February rose 9.34% from a year ago, from $407,000 to $445,000. Thirteen counties reported double-digit increases, while four counties had price drops. This is consistent with recent activity in perimeter areas as homebuyers seek value. While we don’t have a crystal ball for these uncertain times, indicators and information on the ground support shows that our market will continue strong. 2020 will rival 2017 with similar short days on market, tight inventory and in many markets, a return to multiple offers.

Nationally, an editor with realtor.com reported the U.S. housing market is already feeling the effects of what could soon be declared a pandemic. The already sluggish luxury real estate market has depended in recent years on an injection of Chinese buyers. Fewer Chinese buyers who account for a “significant chunk” of luxury buyers are touring properties in the U.S., thanks in part to the temporary travel ban enacted to prevent the spread of the virus. China has been the most important source of foreign demand for real estate. Wealthy Chinese buyers often purchase luxury properties, such as high-rise condos, in California and New York. The upper-end market can expect to be softer as a result.

For FREE Online Home Evaluation,

please fill up the form below

Looking for Investment Properties?

Let us know what you need

If you have any questions or comments you would like answered in next month's newsletter, email me at [email protected] and they will be included in the market update.

OR if you would like more information on our unique systems and programs, call us at 206-391-7766 or visit our website www.GeorgeMoorhead.com